If a company hires an auditing company, the auditor from the external company will use the facts and figures provided by the company. People may misreport data or outright hide evidence of misdeeds from auditors because there were no internal controls to stop them, and the auditor will accept the data, assuming it can from a source of truth. When the audit is completed it will be based on the wrong numbers, which means that the audit itself will be wrong as well. For example, if an audit requires a low detection risk to counter a high control risk, auditors may rely less on control testing and conduct extensive substantive procedures to form a valid audit opinion.

What Is Inherent Risk?

These risks are important to take into account as they can drastically mislead investors and are generally best combatted by getting several qualified auditors to go over the books. Detection risk may occur unintentionally in that an auditor may miss an error accidentally. In other cases, an auditor may misinterpret the figures on the financial statements they’re charged with reviewing that it results in one or more errors. Having identified the audit risk candidates are often required to identify the relevant response to these risks. A common mistake made by candidates is to provide a response that management would adopt rather than the auditor.

Risk Advisory Intern Summer 2025 Business Process

By doing so, they position themselves at the forefront of the profession, ready to tackle audit risks with confidence and precision. Audit risk is defined as ‘the risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. Hence, audit risk is made up of two components – risks of material misstatement and detection risk. In the strict field of reviewing financial statements, detection risks show how likely it is that auditors will miss critical mistakes despite employing their best efforts following auditing standards. A common example arises in the context of complex financial transactions, where the intricate nature of the transactions themselves could obscure significant misstatements from the auditor’s view. This is particularly pertinent when audit sampling — a technique widely used to infer the accuracy of financial records — is deployed.

Internal Audit Technology Intern Summer 2025

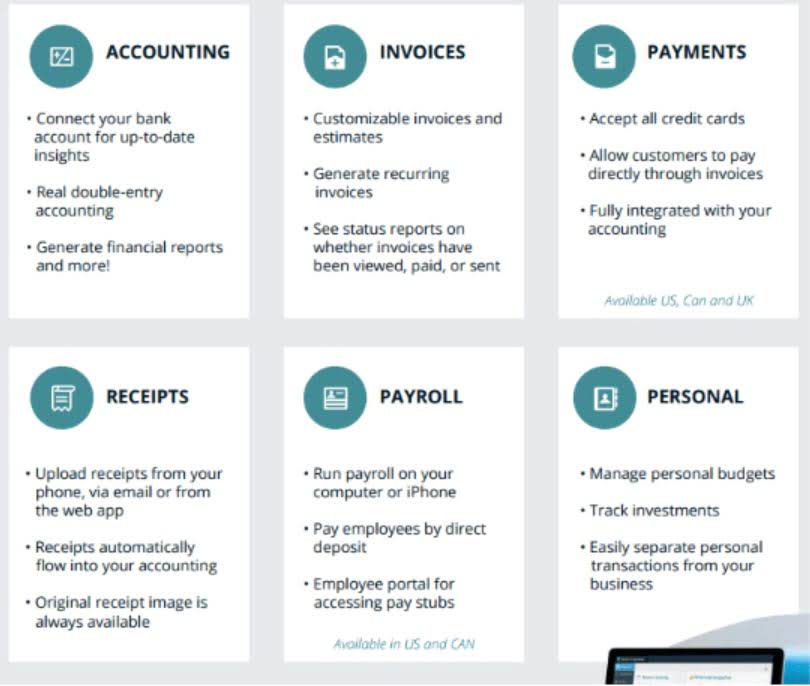

Adjusting the level of inherent risk, control risk, and detection risk allows auditors to minimize overall audit risk and provide accurate and reliable financial information to stakeholders. Mastering audit risks in today’s fast-paced and complex financial environments requires a forward-thinking approach that embraces innovation such as audit management https://www.bookstime.com/ software. Auditors use cutting-edge tools and procedures to meticulously identify audit risks and maintain the accuracy of financial reporting. Through a comprehensive understanding of audit risks — including inherent, control, and detection risks — auditors are better equipped for audit engagements that ensure the accuracy of financial statements.

Audit Risk Assessment Resources

Staff Training and Standardized Procedures ensure that the audit team is highly skilled and operates cohesively and consistently across all engagements. This uniformity is essential for maintaining the quality and reliability of the audit process, reducing the potential for oversight and errors. Regularly updating training programs and procedures also helps the audit team adapt to new regulatory changes and emerging industry practices, thereby staying current and competent in a dynamic financial landscape. Audit risk model is used by the auditors to manage the overall risk of an audit engagement. For Charismatic Electronics Inc., the inherent risk could be considered moderate to high. As a result, there are inherent risks related to product obsolescence, technology changes, and remaining competitive.

- The detection risk of audit evidence for an assertion failing to detect material misstatements is 5%.

- A common mistake made by candidates is to provide a response that management would adopt rather than the auditor.

- This enables them to tailor their audit procedures and allocate resources effectively, ensuring a comprehensive and reliable audit.

- Understanding and evaluating each component allows auditors to plan their procedures and allocate resources effectively to minimize the overall audit risk.

- Detection risk is the risk that the auditors will unintentionally not discover major problems and create a report which paints a good picture of the company.

- Its practical usage empowers auditors to adapt their approach based on the unique circumstances of each entity being audited, ensuring the audit procedures align with the specific risks and complexities of the business.

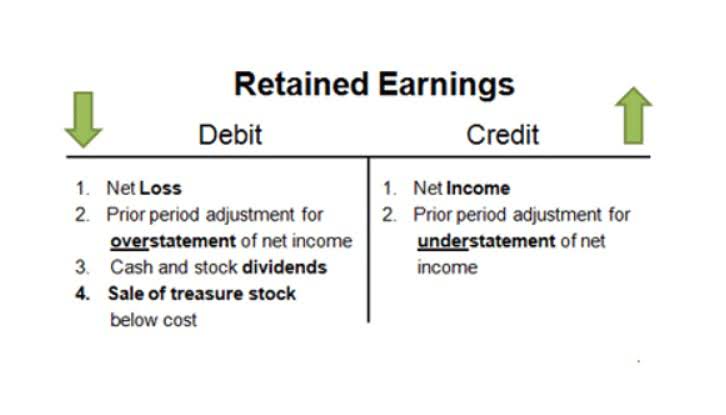

Audit risk is the risk that the audit will have human errors in it and thus may not be able to uncover all the problems in the organization. Audit risk model is inherent in all audits and needs to be mitigated through audit reviews and assessments carried out by someone other than the original auditor. Inherent riskThis is the susceptibility of an assertion about a class of transaction, account balance, or disclosure to a misstatement that could be material, either individually or when aggregated with other misstatements, before consideration of any related controls. Complex financial transactions, such as those during the lead-up to the financial crisis, can be difficult for even the most intelligent financial professionals to understand.

The auditor must assess each component to determine an appropriate level of audit risk and design and execute audit procedures that address the identified risks. The ultimate goal is to obtain sufficient and appropriate audit evidence to support the auditor’s opinion on the fairness of the financial statements. However, there’s some level of detection risk involved audit risk model with every audit due to its inherent limitations. This includes the fact that financial statements are created with a standard range of acceptable numerical values. The first component of the formula is inherent risk, which refers to the susceptibility of an assertion or transaction class to material misstatement before considering internal controls.

Answering audit risk questions

- The auditor’s letter follows a standard format, as established by generally accepted auditing standards (GAAS).

- There’s always a risk of fraudulent or incomplete information being given, which means an auditor cannot say with 100% certainty that their opinions will be correct.

- It is influenced by factors such as the nature of the company’s business, the complexity of transactions, and financial reporting history.

- At this juncture, auditors embark on a journey to pinpoint and appraise risks capable of skewing the reliability and accuracy of financial statements.

- For example, the inherent risk could potentially be higher for the valuation assertion related to accounts or GAAP estimates that involve the best judgment.